TIPS and Treasury Bills

Note: I had intended this article to be a sequel to Tuesday’s “TIPS vs. Balanced Funds for Income: The History,” providing a future outlook. However, when preparing that material, I realized that I could not do the topic justice without discussing a peculiar aspect of TIPS: Their relative performance is better when inflation is low.

Treasury bills are the primary investment rival for long-term Treasury Inflation-Protected Securities. Conventional Treasury bonds do not adjust to marketplace movements, and other fixed-income securities are not backed by the United States government. However, like TIPS, Treasury bills possess both attributes.

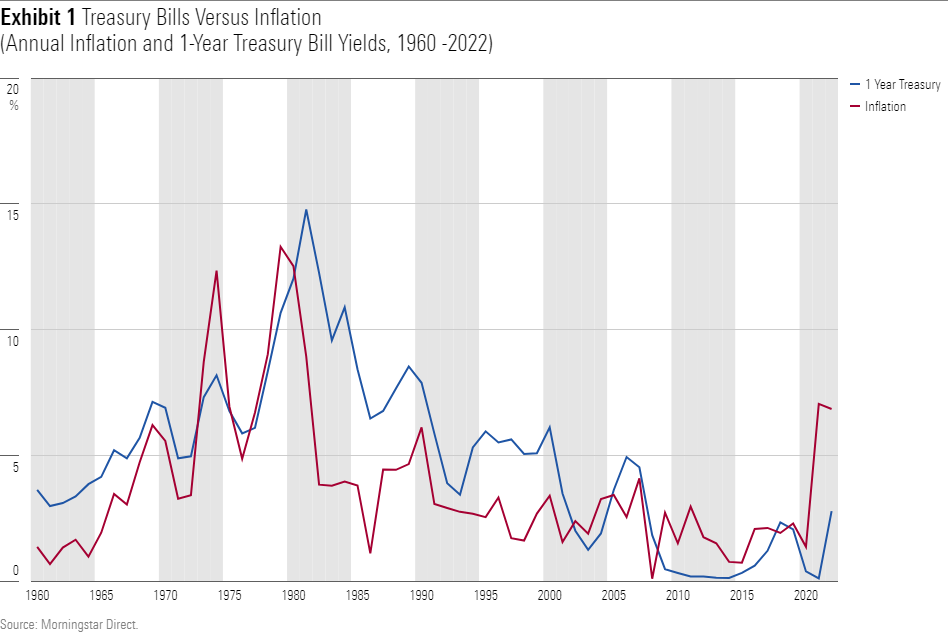

Officially, of course, Treasury bills differ from TIPS in that they are not specifically built to track the inflation rate. Unofficially, though, they have done just that. In 1959, the Treasury Department began to regularly issue one-year Treasury bills. Since then, the yields on those investments have consistently tracked the Consumer Price Index. Where inflation has gone, so have one-year Treasury bills.

During that period, the bills yielded an average of 4.85%, while inflation was 3.78%. Their real return was therefore 1.03%. (Or 1.07%, if you prefer the almost-accurate shortcut.) That is close to the current real yield on 30-year TIPS, which is 1.46%. One could therefore regard the choice for investors seeking safe, inflation-protected income as consisting of two investments with similar expected returns but different features. One is stable with an implicit inflation adjustment, while the other is volatile, with explicit insurance. (Another way of stating the matter, per Bill Bernstein, is that short Treasuries are risky for the long term and riskless for the short term, while long TIPS are the opposite.)

The Effect of Inflation Rates

Although true, that analysis is incomplete. Missing is the fact that the yields of those two investments not comparable. They certainly seem to be. Treasury bills have demonstrably gained 1% more than the inflation rate, while long TIPS are guaranteed by the government to deliver slightly more. But in practice, those figures convey quite different things.

To explain, let’s consider two hypothetical investors. One places $10,000 into freshly issued one-year Treasury bills, spending the profit when those bills mature (because Treasury bills pay their income through appreciation rather than with coupons, the margin between their purchase price and their redemption value represents their yield). She then rolls 10,000 over into a new batch of one-year bills. The other investor puts $10,000 into 30-year TIPS, spends that year’s real yield, and holds.

For this exercise, I will treat the one-year Treasury bills conservatively. Rather than assume they will provide a 1% real yield, per their history, I will stipulate that they will deliver no real yield at all. Their aggregate return will exactly match the rate of inflation. Given that condition, surely 30-year TIPS will provide the higher yield.

Not so fast. Admittedly, TIPS will easily win the contest if the inflation rate is zero. Were that to occur, by the terms of this exercise, a strategy of investing in one-year Treasury bills would pay nothing over next 30 years. (If that seems unrealistic, consider how low one-year rates have been in recent years, even when inflation was modestly positive.) Meanwhile, the 30-year TIPS would pay a steady $146 on that $10,000 investment. That figure would not increase—with inflation being nonexistent—but it need not rise for TIPS to beat one-year Treasuries.

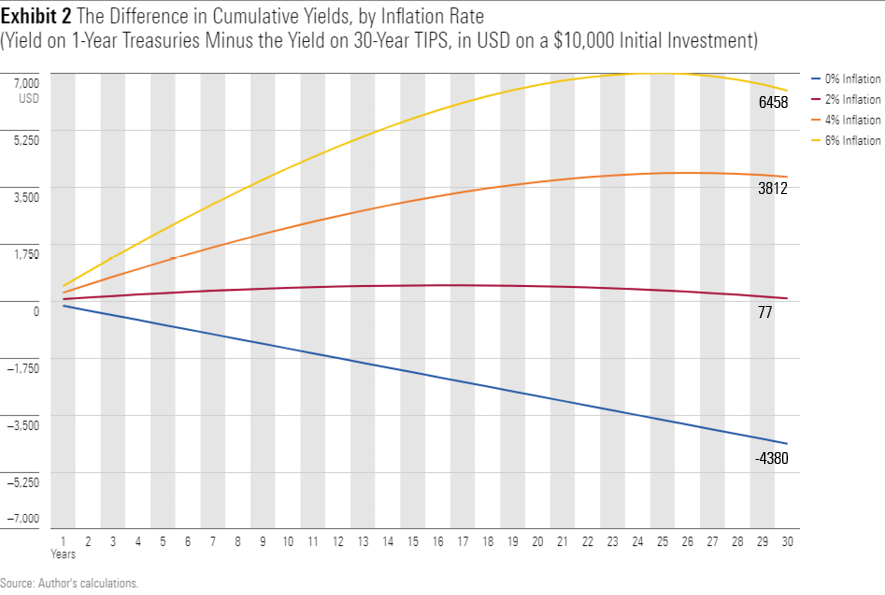

So far, so good. The investment with the higher real yield also pays a higher actual yield. However, the outcome is quite different if inflation rages. Say that inflation averages 6%. In that case, one-year Treasuries would initially pay $600, with 30-year TIPS once again at $146. Eventually, the yield on TIPS will catch up because each year inflation will boost that security’s principal value and thus the cash payments it distributes, based on its 1.46% real yield, while the one-year Treasury will be stuck on $600. However, the one-year Treasuries have a very large lead!

Too large, in fact, to be caught over the next 30 years. The following chart shows the gap in cumulative income between the tactic of owning one-year Treasury bills with zero real yield and that of owning 30-year TIPS with a real yield of 1.46%. A positive figure indicates that the one-year Treasuries paid more cash through that point in time, while a negative figure demonstrates an edge for 30-year TIPS.

That result is doubly odd. First, the relative results of two inflation-protected investments vary greatly according to the level of inflation. Who would have guessed that? Not I. What’s more, the investment that has the lower real yield offers a significantly higher yield over a 30-year period in two of the four cases. Curiouser and curiouser.

Considering Present Value

The above calculation, it must be confessed, ignores two critical factors. One is the time value of money. Income paid today is worth more than income that arrives tomorrow. For inflation rates above 1.46%, that math favors Treasury bills, which boast the higher initial yield. The other item is principal repayment, which conveys an advantage to TIPS. Unless the inflation rate is zero, TIPS will be worth more than $10,000 when redeemed 30 years out.

As it turns out, the latter item is more important than the former. Evaluating the strategies by their present value shows TIPS to be the superior option no matter the inflation rate. (For example, 30 years into the strategy a 6% annual inflation rate will have eroded 83% of the purchasing power of the one-year Treasury.) That outcome makes sense, given that the exercise awarded the TIPS strategy a sizable advantage in real yield. Normality has been restored.

Summary

In one sense, 30-year TIPS are the most foreseeable investment. For three full decades, long TIPS deliver real cash flows that can be known entirely in advance. Consequently, should they so desire, TIPS owners can use their securities to construct an investment ladder that provides a payment surety that cannot be otherwise achieved.

From another perspective, though, long TIPS have strange and unpredictable properties. Not only do their market prices sometimes defy expectations, as with last year’s meltdown, but when competing for yield against their closest competitors, short conventional Treasuries, they are affected by the prevailing inflation rate—although not in the direction one would anticipate.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

Article From & Read More ( Long TIPS Are Wacky - Morningstar )https://ift.tt/PR1CXtK

Tidak ada komentar:

Posting Komentar