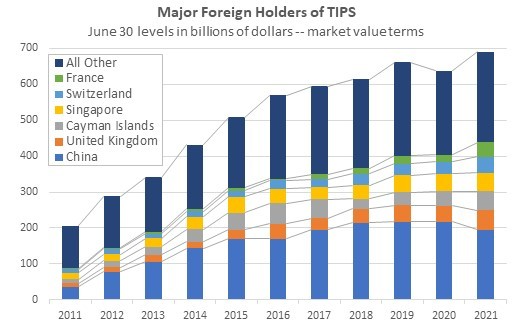

New data on global capital allocations show that foreign holdings of U.S. Treasury Inflation-Protected Securities broadened in 2021, as global investors reduced their exposure to nominal cash-generating assets in response to high inflation. Chinese investors trimmed their portfolios of TIPS by $22B, but the rest of the world increased its allocation by $75B. As of last June, foreign investors comprised 43 percent of the TIPS market versus 38 percent in markets for nominal bonds. This trend towards TIPS looks set to continue: Fears of global recession might cause central banks to scale back their rate hiking plans, reigniting inflation concerns around the world and encouraging investors to add directly correlated inflation protection to their portfolios. After all, because the government can’t inflate away its inflation-protected debt, the TIPS market will likely see high demand as long as inflation remains a concern.

Inflation around the world will likely push a large group of investors – with different investing styles and different objectives – to the TIPS market, helping create depth and reliable price discovery in a market that has historically lacked liquidity. Especially as the Fed rolls back its asset purchase programs (which tend to distort market prices), TIPS prices will more accurately reflect the market price for inflation insurance. From a policy standpoint, a more efficient TIPS market might help the Fed nowcast inflation expectations and set policy accordingly. It seems that the TIPS market is on track to become more relevant over the years, not only as an option for global investors but also as an increasingly reliable source of information for central bank policymakers.

Source: MMO for May 23, 2022 (wrightson.com)

Thomas Triedman, a sophomore at Yale, is a Summer 2022 Collegiate Associate at the Manhattan Institute

Interested in real economic insights? Want to stay ahead of the competition? Every Wednesday, e21 delivers a short email that includes e21 exclusive commentary and the latest market news and updates from around the Web. Sign up for the e21 Weekly eBrief.

Article From & Read More ( Inflation and TIPS - Economics21 )https://ift.tt/z0Mg1fx

Tidak ada komentar:

Posting Komentar