Buying a home for the first time can be a daunting process. There's a lot of jargon to navigate, not to mention the capital you need to make the move in the first place.

Housing Market 2023: Prices Are Now So High That Banks Are Losing Money on Mortgages

Discover: 3 Things You Must Do When Your Savings Reach $50,000

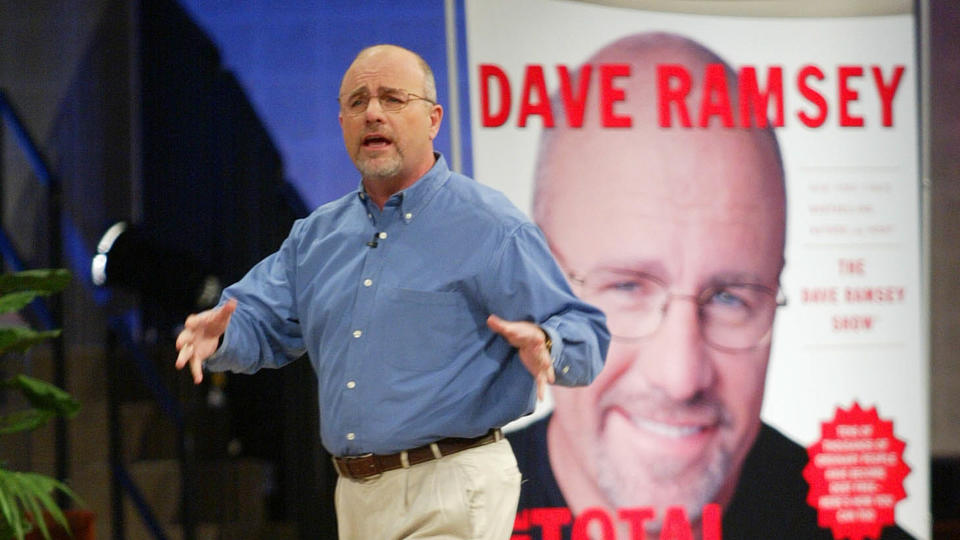

Personal finance guru Dave Ramsey recently gave advice on "The Ramsey Show" to someone looking to buy a house in the next year. The person who wrote in asked: Besides putting 20% down, what are some other things to know when buying a home.

Ramsey, who previously has offered advice on paying off a mortgage faster, provided seven more tips for first-time homebuyers.

Make Sure Your Mortgage Payment Is Less Than 25% of Your Take-Home Income

When looking for a new home, you'll need to figure out how much you can afford to pay every month in your mortgage payment. Ramsey recommended that payment -- including taxes and insurance -- be no more than 25% of what you're bringing in every month.

Learn: Why Nobody Is Buying Vacation Homes Anymore

Check Out: 5 Affordable Up-and-Coming US Locations To Buy Vacation Property in 2023

Choose a 15-Year Fixed-Rate Mortgage

Ramsey said to opt for a 15-year fixed-rate mortgage, rather than an adjustable rate mortgage. This way, what you're paying stays the same, even if the economy takes a turn for the worse. You might have a higher monthly payment than you would with an adjustable rate mortgage, but that payment will never change, and you'll likely save money in the long run.

Take Our Poll: What Kind of Money Advice Would You Most Trust From a Celebrity Expert Such as Warren Buffett, Mark Cuban or Suze Orman?

Get Title Insurance

Title insurance protects the buyer and the lender from damage or loss caused by issues with the property title. This covers problems like outstanding liens, back taxes and conflicting wills. Title insurance is especially effective against issues you discover after you buy a property. Say you purchase a home and then you find out there's a lien on the property. Title insurance ensures you won't be held responsible for paying it off.

Opt for a Property Survey

If you are buying a house (not a condo or townhouse), Ramsey said it's important to request a property survey so you know exactly what you're getting with your purchase. A survey lets you know exactly where your property lines are and the legal description of the purchase.

Ramsey said there is one instance where you don't need to get a property survey: If you're getting a standard subdivision lot that's changed hands three or four times.

Ask for a Home Inspection

This is a tip that Ramsey said doesn't just apply to first-time homebuyers. "I've bought and sold several thousand pieces of real estate; I get a home inspection," Ramsey said.

A home inspection can reveal any major or minor issues, including electrical problems and foundation concerns.

Find: 15 Cities Where Houses Are Best Bargains Right Now

Don't Buy an Ugly House, No Matter the Price

Ramsey said the first home he bought was a great deal, but it wasn't pretty to look at. The problem with buying these so-called ugly homes is that there isn't going to be a great resale value on them, no matter how much work you do.

"There's a reason it's cheap when you bought it," he said, "and there will be a reason it's cheap when you sell it."

Try To Buy Boring

Instead of getting an ugly house for a good deal or spending too much money on the best-looking house on the block, Ramsey said to aim for the average, "boring" home.

"Boring means less risk going in and less risk going out," said Ramsey, who added that having to make small cosmetic changes like carpet and paint are OK. He cautioned against purchasing a home with any big projects needed to make it look presentable.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey’s 7 Tips for First-Time Homebuyers

Article From & Read More ( Dave Ramsey’s 7 Tips for First-Time Homebuyers - Yahoo Finance )https://ift.tt/FdVjpL9

Tidak ada komentar:

Posting Komentar